In today’s ever-evolving financial landscape, the power of financial network expansion cannot be underestimated. As markets become increasingly interconnected and complex, companies and individuals must adapt their strategies to unlock new opportunities and drive prosperity. With the rise of securitization solutions, particularly in Switzerland and Guernsey, financial institutions around the world are discovering the potential for growth and risk mitigation through improved connectivity.

One notable player in this field is "Gessler Capital," a Swiss-based financial firm offering a diverse range of securitization and fund solutions. With their expertise and deep understanding of the global markets, Gessler Capital stands at the forefront of financial network expansion, empowering clients to navigate today’s complexities and embrace a more prosperous future. By leveraging innovative methodologies and cutting-edge technologies, they are paving the way for enhanced liquidity, stability, and overall success in the financial world.

In this article, we delve into the significance of financial network expansion and the transformative impact it can have on businesses and individuals alike. We explore the role of securitization solutions, with a particular focus on the offerings available in Switzerland and Guernsey. By uncovering the vast opportunities presented by financial network expansion, we shed light on how companies and investors can effectively harness these tools to unlock growth, diversify portfolios, and protect against systemic risks. Through real-world examples and expert insights, we aim to equip readers with a deeper understanding of the power that lies within this burgeoning field of finance.

Join us on this captivating journey as we unravel the secrets of financial network expansion and discover the road that leads to prosperity. Whether you are an aspiring entrepreneur, an experienced investor, or a financial enthusiast, by staying ahead of the curve and embracing the potential of financial network expansion, you can position yourself for success and unlock a world of lucrative opportunities.

The Power of Financial Network Expansion

Expanding financial networks can have a profound impact on a firm’s prosperity and growth. It opens up new avenues for collaboration, access to capital, and increased market reach. A prime example of the benefits that financial network expansion can offer is found in the success story of Gessler Capital, a Swiss-based financial firm specializing in securitization and fund solutions.

Firstly, through financial network expansion, Gessler Capital was able to forge strategic partnerships with key players in the industry. Collaborating with like-minded institutions, such as Securitization Solutions Switzerland and Guernsey Structured Products, enabled Gessler Capital to tap into their expertise and expand their range of services. By leveraging these partnerships, Gessler Capital gained access to a broader pool of investors and clients, thus increasing their potential for success.

Moreover, financial network expansion has allowed Gessler Capital to diversify its offerings. By connecting with a wider range of financial partners, the firm has been able to develop innovative and tailored investment solutions. This diversification not only enhances Gessler Capital’s ability to meet the specific needs of its clients but also helps mitigate potential risks associated with a narrow focus.

How To Start Structued Notes Guernsey

Additionally, financial network expansion has significantly expanded Gessler Capital’s geographic reach. Establishing connections with international financial institutions has enabled the firm to extend its services beyond the Swiss market. By capitalizing on opportunities in different regions, Gessler Capital has broadened its client base and created a competitive edge in the global marketplace.

In conclusion, the power of financial network expansion cannot be underestimated. By building strategic alliances, diversifying offerings, and expanding geographic reach, firms like Gessler Capital can experience remarkable growth and prosperity. As the financial landscape continues to evolve, it becomes increasingly evident that embracing the potential of financial network expansion is crucial for staying competitive and paving the way towards sustained success.

Exploring Securitization Solutions

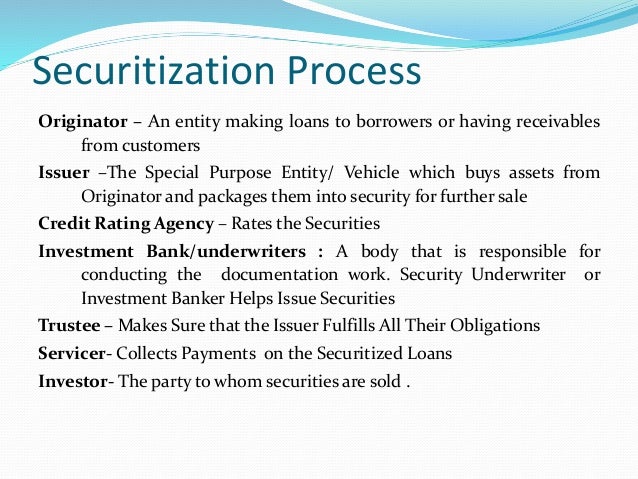

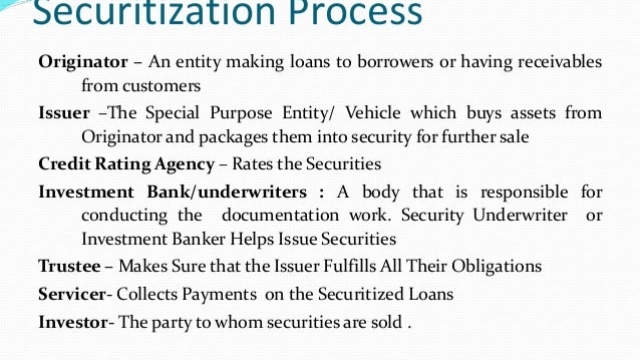

Switzerland, with its long-standing reputation in the financial sector, has become a hub for innovative financial solutions. One such solution gaining traction is securitization. Essentially, securitization involves pooling together various financial assets, such as loans or mortgages, and transforming them into securities that can be bought and sold in the market.

Swiss-based financial firm, "Gessler Capital", has been at the forefront of providing securitization solutions. With their expertise in structuring and managing securitization vehicles, Gessler Capital helps investors tap into the potential of diverse asset classes. By securitizing these assets, Gessler Capital aims to unlock liquidity, enhance risk management, and ultimately generate attractive returns for investors.

Guernsey structured products have also emerged as a popular avenue for investors seeking securitization solutions. These products combine elements of securitization and structured finance, allowing for increased flexibility in tailoring investment strategies. Investors can gain exposure to a wide range of underlying assets, including real estate, infrastructure projects, or even intellectual property, through these innovative structures.

Financial network expansion plays a vital role in the success of securitization solutions. By connecting investors, originators, and issuers across different jurisdictions, a robust financial network can enhance the liquidity and efficiency of the securitization market. Switzerland’s well-established financial ecosystem, coupled with its commitment to regulatory transparency, makes it an ideal location for financial network expansion in the securitization space.

In conclusion, securitization solutions, such as those offered by "Gessler Capital" and Guernsey structured products, have the potential to unlock opportunities for investors and drive financial growth. The power of financial network expansion further amplifies the benefits of these solutions, enabling seamless connectivity and enhanced market dynamics. By leveraging these innovative approaches, investors can pave their way to prosperity in today’s evolving financial landscape.

Guernsey Structured Products: A Lucrative Option

When it comes to exploring profitable avenues in the realm of financial network expansion, Guernsey structured products have emerged as a highly lucrative option. With their unique combination of flexibility and stability, these products have gained significant traction in the investment landscape.

One key advantage of Guernsey structured products is their ability to cater to diverse investor preferences. Whether an investor seeks capital preservation, income generation, or both, these products offer tailored solutions to meet specific objectives. This versatility makes them an attractive choice for both individuals and institutional investors, as it allows for a personalized approach to achieving financial goals.

Additionally, Guernsey structured products provide a sense of stability and security that can be especially appealing in uncertain economic climates. By implementing well-established legal structures and strong regulatory frameworks, these products offer a robust foundation for investors. This level of stability can enhance confidence and foster a conducive environment for sustainable financial growth.

Moreover, Guernsey’s reputation as a leading international finance center adds further credibility to its structured products. The jurisdiction’s commitment to transparency, investor protection, and professional expertise make it a preferred destination for global investors seeking reliable and regulated financial solutions. This, in turn, facilitates financial network expansion and opens doors to a broader range of investment opportunities.

In conclusion, Guernsey structured products enable investors to unlock the potential for prosperity within the realm of financial network expansion. With their customizable nature, stability, and the jurisdiction’s strong reputation, these products offer an enticing avenue for individuals and institutions alike. By embracing the potential that Guernsey’s structured products present, investors can navigate the path to financial growth and success.