Running a business in California can be an exhilarating experience, filled with countless opportunities and the promise of success. However, amidst the excitement, it’s crucial not to overlook the importance of protecting your business from potential risks. Commercial insurance is a powerful tool that can help safeguard your hard work and investments, offering you peace of mind knowing that your business is secure.

Navigating the world of commercial insurance can be daunting, but fear not, we are here to guide you through the process. Whether you own a restaurant, a small retail store, or operate a fleet of vehicles, understanding the intricacies of commercial insurance is essential to ensure your business is adequately protected. In this comprehensive guide, we will delve into the intricacies of commercial insurance in California, providing you with the insights and knowledge to make informed decisions about your business’s insurance needs.

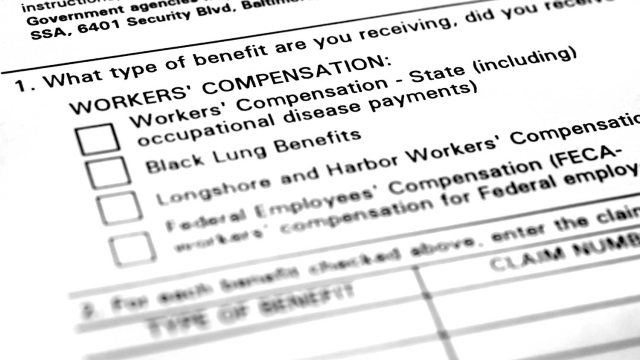

Let’s begin by exploring the intricacies of restaurant insurance in California. As a restaurant owner, you’re well aware of the unique challenges and risks that come with the bustling nature of the industry. From potential kitchen accidents to customer liability claims, having appropriate insurance coverage is crucial to mitigate these risks. We’ll break down the various types of restaurant insurance policies available, such as general liability insurance, property insurance, and workers’ compensation insurance, providing you with a roadmap to ensure your restaurant is comprehensively protected.

Next, we’ll shift our focus to commercial auto insurance in California. For businesses that rely on automobiles as part of their operations, ensuring adequate coverage is imperative. From delivery services to construction companies with fleets of work vehicles, commercial auto insurance is designed to protect against potential accidents, property damage, and liability claims. We’ll explore the different types of commercial auto insurance policies available, discuss the factors that influence premiums, and offer tips on how to choose the right coverage for your business’s specific needs.

With commercial insurance, you have the power to proactively protect your business and its assets. By understanding the intricacies of commercial insurance in California and having the right coverage in place, you can confidently navigate the path to business protection. So, strap in, and let’s embark on this journey together, as we unlock the power of commercial insurance and ensure the longevity and success of your California business.

Understanding Commercial Insurance

Starting and running a business can be a thrilling endeavor, but it also comes with its fair share of risks and uncertainties. That’s where commercial insurance steps in. Commercial insurance serves as a protective shield for businesses, helping to mitigate potential financial losses in the face of unforeseen events. Whether you’re a small business owner, a restaurant owner, or operate a fleet of vehicles in California, having a solid understanding of commercial insurance is vital to safeguarding your business interests.

In California, commercial insurance provides a safety net, offering businesses the peace of mind they need to focus on growth and success. For entrepreneurs in the bustling Golden State, it’s crucial to have a comprehensive understanding of commercial insurance, as it can protect against a wide range of perils such as property damage, liability claims, and even employee injuries. By investing in the right commercial insurance policy, you can ensure the longevity and stability of your California-based business, regardless of its size or industry.

One specific area where commercial insurance plays a significant role is within the restaurant industry. With the vibrant culinary scene in California, owning a restaurant can be an incredibly rewarding experience. However, it’s not without its challenges. From kitchen accidents to foodborne illnesses, restaurants face a unique set of risks and liabilities. Understanding the nuances of restaurant insurance in California is therefore essential for restaurant owners to protect their establishments, employees, and customers from potential harm and financial setbacks.

Furthermore, if your business relies on a fleet of vehicles in the state of California, commercial auto insurance becomes crucial. Whether you own a small delivery service or manage a large transportation company, having robust commercial auto insurance coverage ensures that your vehicles, drivers, and cargo are protected in the event of accidents, theft, or any other unfortunate incidents. Being well-versed in the intricacies of commercial auto insurance in California will help you navigate the requirements, regulations, and coverage options available, enabling you to make informed decisions that safeguard your business assets.

Remember, when it comes to commercial insurance in California, knowledge is power. Understanding your insurance needs, exploring appropriate coverage options, and partnering with a reliable insurance provider can unlock the true potential of commercial insurance and provide your business with the protection it deserves.

The Importance of Restaurant Insurance

Running a restaurant in California comes with its fair share of risks and challenges. From unexpected accidents to liability claims, the restaurant industry can be a risky business. That’s why having the right commercial insurance in place is crucial to protect your investment and give you peace of mind.

When it comes to ensuring the safety and security of your restaurant, commercial insurance in California is essential. From fire damage to theft, there are numerous potential threats that can impact your business. Having a comprehensive insurance policy can help cover the costs associated with these risks, minimizing the financial impact on your restaurant.

Professional Liability Insurance in California

One aspect of commercial insurance that is particularly important for restaurants is liability coverage. In the food service industry, accidents can happen, and customers or employees may get injured. Without proper insurance protection, your restaurant could face lawsuits and significant financial liabilities. Commercial insurance can help cover legal expenses and medical costs, ensuring that your restaurant can continue to operate smoothly even in the face of unforeseen incidents.

Additionally, commercial insurance can also provide coverage for property damage and business interruption. Imagine if your restaurant suffers a fire or water damage, rendering it temporarily closed. With the right insurance coverage, you can receive compensation for the lost income during the closure and have the necessary funds to repair and rebuild your establishment.

In conclusion, restaurant insurance is a crucial investment for any business owner in California. By safeguarding your restaurant against potential risks, you can focus on what matters most – providing excellent dining experiences to your valued customers and growing your business. Don’t overlook the importance of commercial insurance, as it can be the key to navigating the path to business protection and success.

Navigating Commercial Auto Insurance

Commercial auto insurance plays a vital role in protecting businesses that rely on vehicles for their operations. Whether you own a delivery service, a construction company, or any other business that uses vehicles, having the right insurance coverage is crucial in California. Let’s explore the key aspects of commercial auto insurance and how it can provide valuable protection for your business.

One of the first steps in navigating commercial auto insurance is understanding the specific coverage options available to you. In California, there are various insurance policies tailored for commercial vehicles, such as vans, trucks, and company cars. These policies provide coverage for accidents, theft, and damage to your vehicles, giving you peace of mind knowing that your business assets are protected.

When selecting a commercial auto insurance policy in California, it’s important to consider your unique business needs. Different industries may require specialized coverage options. For example, if you own a restaurant in California, you may want to ensure that your policy covers any food-related equipment or goods that are transported in your vehicles. Understanding your specific industry requirements will help you choose the right coverage that aligns with your business needs.

Furthermore, navigating commercial auto insurance involves determining the level of coverage you need. California law mandates certain minimum coverage requirements for commercial vehicles, including bodily injury liability and property damage liability coverage. However, it’s often advisable to obtain coverage beyond the minimum requirements to safeguard your business from potential financial risks in case of accidents or lawsuits.

In conclusion, commercial auto insurance is an essential component of business protection, especially for those operating in California. By understanding the available coverage options, considering your industry’s specific needs, and determining the appropriate level of coverage, you can effectively navigate the world of commercial auto insurance and safeguard your business on the roads of California.